Market structure shows how price behaves over time, the pattern of swing highs and swing lows. It tells you if buyers or sellers are currently in control of the market.

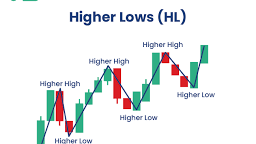

- When price makes higher highs (HH) and higher lows (HL) the market is in an uptrend.

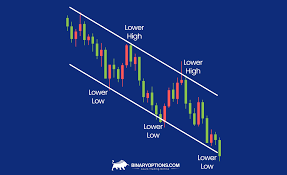

- When price makes lower highs (LH) and lower lows (LL) the market is in a downtrend.

- When price moves between a fixed range without forming new highs or lows the market is ranging or consolidating.

Why Understanding Market Structure Is Important

- Improves Trade Timing: You can spot when a trend begins or ends.

- Prevents Counter-Trend Trading: Helps you avoid entering trades against the main market direction.

- Enhances Risk Management: Knowing structure points helps in setting accurate stop-loss and take-profit levels.

- Boosts Accuracy: You’ll identify high-probability trading setups with clear directional bias.

Types of Market Structure in Forex

Forex market structure can generally be categorized into three major types:

1. Uptrend (Bullish Market Structure)

An uptrend occurs when price continuously forms higher highs (HH) and higher lows (HL). This means buyers are dominating the market.

How to Trade an Uptrend:

- Wait for a retracement (pullback) to a support or trendline.

- Look for bullish reversal candlestick patterns (like bullish engulfing or pin bar).

- Enter a buy trade aiming for the next higher high.

- Place your stop-loss below the previous higher low.

2. Downtrend (Bearish Market Structure)

A downtrend occurs when price consistently makes lower highs (LH) and lower lows (LL) showing that sellers are in control.

How to Trade a Downtrend:

- Wait for a pullback to a resistance area or trendline.

- Look for bearish candlestick patterns (like bearish engulfing or shooting star).

- Enter a sell trade targeting the next lower low.

- Place your stop-loss above the previous lower high.

3. Range-Bound (Sideways Market Structure)

A ranging market happens when price moves between a defined support and resistance level without breaking out in either direction. This shows indecision between buyers and sellers.

How to Trade a Ranging Market:

- Buy near support zones.

- Sell near resistance zones.

- Avoid trading in the middle of the range to reduce risk.

- Use oscillators (like RSI or Stochastic) to confirm overbought or oversold conditions.

Additional Market Structure Concepts

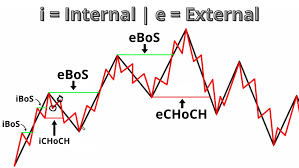

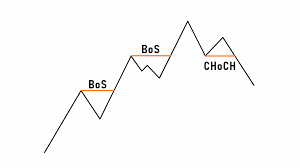

4. Market Structure Break (MSB)

When the price breaks above a previous high or below a previous low, it signals a change in structure.

- A break of structure to the upside (BOS) may indicate the start of an uptrend.

- A break of structure to the downside may signal the start of a downtrend.

5. Change of Character (CHoCH)

A Change of Character happens when the market shifts from one type of structure to another for example, from an uptrend to a downtrend.

This is often the first signal of a potential trend reversal.

How to Trade CHoCH:

- Wait for confirmation (a break of the previous swing point).

- Enter trades in the new direction after a retracement.

In Summary

Market structure is the backbone of technical analysis in forex. When you understand how to read the pattern of highs and lows, you can anticipate market moves with confidence and precision.

Whether the market is trending or ranging, always align your trades with the dominant structure and you’ll find your trading results becoming more consistent over time.

READ OTHER POST

Common MT5 Problems And How To Fix Them

Leave a comment